Five Reasons RIAs Should Use Index Annuities For Their Clients

In this article, we will delve into the topic of index annuities and discuss five compelling reasons why RIAs should consider incorporating them into their clients’ portfolios.

In this article, we will delve into the topic of index annuities and discuss five compelling reasons why RIAs should consider incorporating them into their clients’ portfolios.

Our team of experts is always available to answer your questions and provide guidance, so you can feel confident in your ability to serve your clients and grow your business.

An inverted yield curve, which is when long-term interest rates are lower than short-term interest rates, has often been an indicator of an upcoming recession.

Historically, inflation has never come back to target levels without a higher level of unemployment, whereas, today, we are at extreme lows.

Overall, I think this paper is extremely timely as retirees are grasping for ideas on how to preserve, yet still accumulate in a challenging market environment.

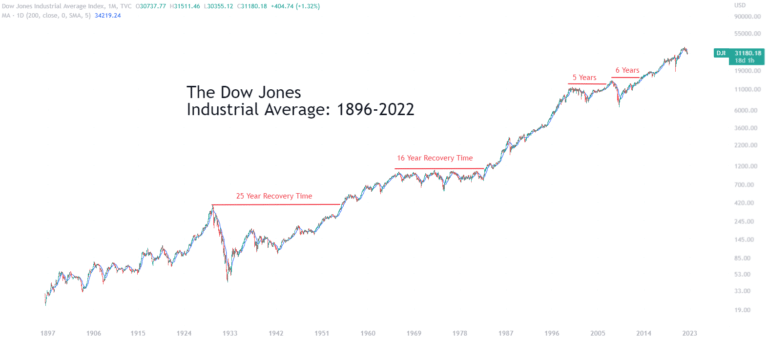

Most of you reading this use a fair amount of annuities and know what they can do for clients in terms of risk mitigation. That being said, many times clients don’t quite understand the big picture, thinking in smaller time frames.

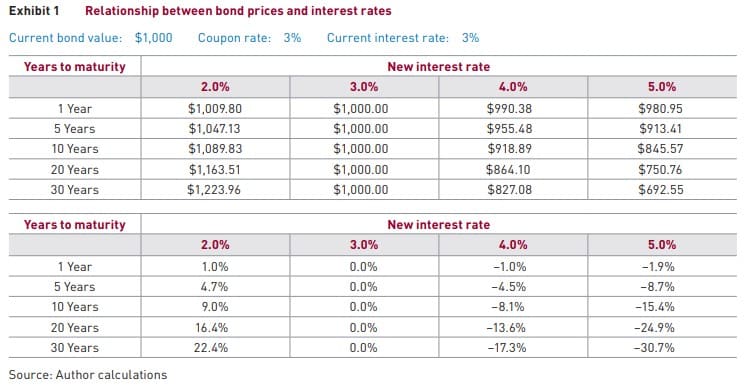

The last several days I’ve had multiple advisory firms reach out asking what pieces I have regarding the relationship between bond prices and interest rates. I have two that I like, so thought I’d share.

It was one of those weeks—and in typical Chicago fashion, the “Windy City” was howling, gusts over 50mph.

It’s time like these where your extra effort as an advisor can really set you apart from the pack.

On our trip last summer, I knew we would be going to no man’s land, Lewis and Clark style. But I didn’t necessarily know how deep.