As I’m writing this the S&P 500 is down 2.80%, Nasdaq is down 3.61%, and potentially most importantly – the 10 year Treasury has marched up to 3.33%. It’s the highest the 10 year Treasury has been since 2011. Not a great look for the fixed income market when stocks are hemorrhaging.

The last several days I’ve had multiple advisory firms reach out asking what pieces I have regarding the relationship between bond prices and interest rates. I have two that I like, so thought I’d share. Hopefully it will help you with your story and messaging in regards to positioning annuities right now. There is a lot of opportunity to educate right now.

First, Wade D. Pfau, Ph.D.,CFA wrote a dynamite piece for Lincoln, “The Heightened Risks of Bonds for Near Retirees”

He did an excellent job explaining the risks of rising interest rates for bonds, why they can be problematic for near retirees and retirees, and how annuities can provide stability during this type of environment. Timely.

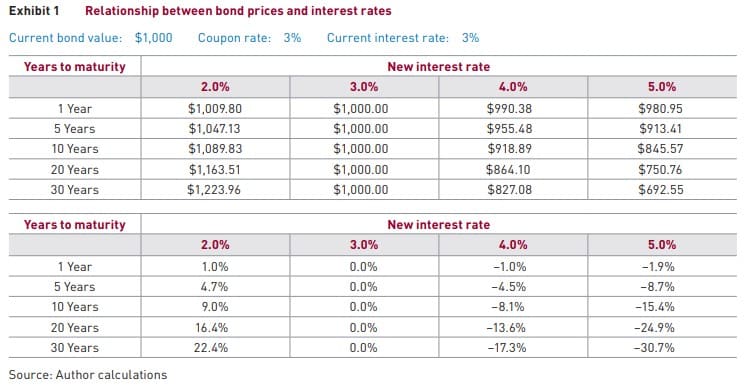

On page 2, there is a nice chart explaining rising rates and bond prices:

Second, Roger Ibbotson’s piece “Fixed Indexed Annuities: Consider the Alternative”. In this piece Roger points out that during both below and above average bond return environments, a FIA can be an “attractive alternative to traditional fixed income options”. One of my favorite charts from his piece below:

Hope these help with your business.