I just got back from an extended trip with the men in my family. We went elk hunting in the mountains of Colorado. After getting back, we are all a little sun burnt, bruised, and skinnier. I guess that’s what happens when you work hard all day, and eat less. That’s the recipe for getting skinnier.

That’s my metaphor about what’s happening to the economy right now. Bridgewater and Associates, one of the largest hedge funds in the world recently released an article called, “Equity Markets Aren’t Pricing in the Next Stage of the Tightening Cycle”.

Their thesis is that we will continue to see tightening, as inflation is still much higher than target, but also because the strength of the labor market is “red hot”. Historically, inflation has never come back to target levels without a higher level of unemployment, whereas, today, we are at extreme lows.

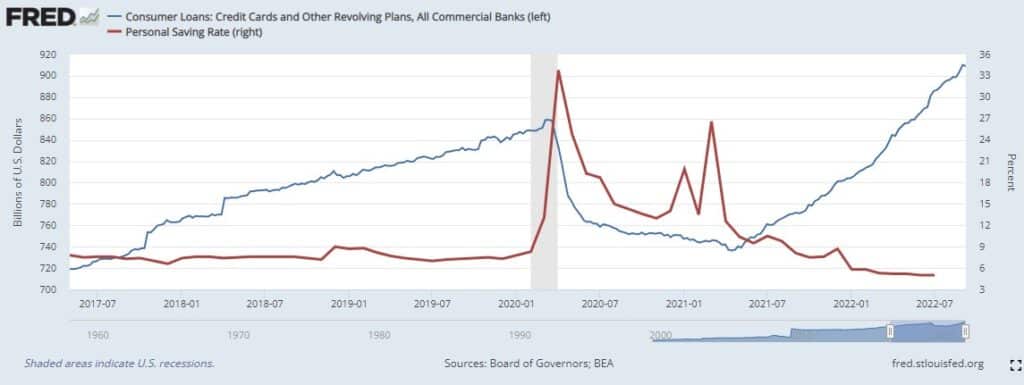

Now, this is quite the game chess because the average American is currently fighting the inflation battle on their own, even with a strong labor market. Consumer loans are racking up and personal savings rates, dwindling. It will be interesting to see how this all plays out, it’s delicate game.

As financial professionals offering conservative insurance products to retirees, I’m not sure I can go as far to say you’re hero’s wearing capes (besides a few of you I know), but the bottom line is that providing downside protection and reliable income in retirement is valuable. And retirees are concerned – rightfully so. *Global government bonds are on track for their worst annual loss since 1949, and the *60/40 (S&P500/US10YR) is on pace for it’s worst calendar year since 1937. We all know a large percentage of advisors do not offer complete downside protection to their clients, this can be an edge for you.

A quote from Jerome Powell at the Jackson Hole Symposium Opening Remarks 2022:

“While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.”

That’s the recipe for now I guess. Eat less and get skinnier.

Let us know if you want to talk shop, we’re here for you.